what does in house financing mean at car dealerships

These dealerships dont rely on outside lenders to approve consumers for financing. Rolls Auto does not offer in-house financing but instead has a large portfolio of banks that are willing to work with all types of credit situations for guaranteed approval for any customer.

Is It True That If I Am Buying A Car From A Dealership I Have To Not Buy It On My First Visit No Matter What Quora

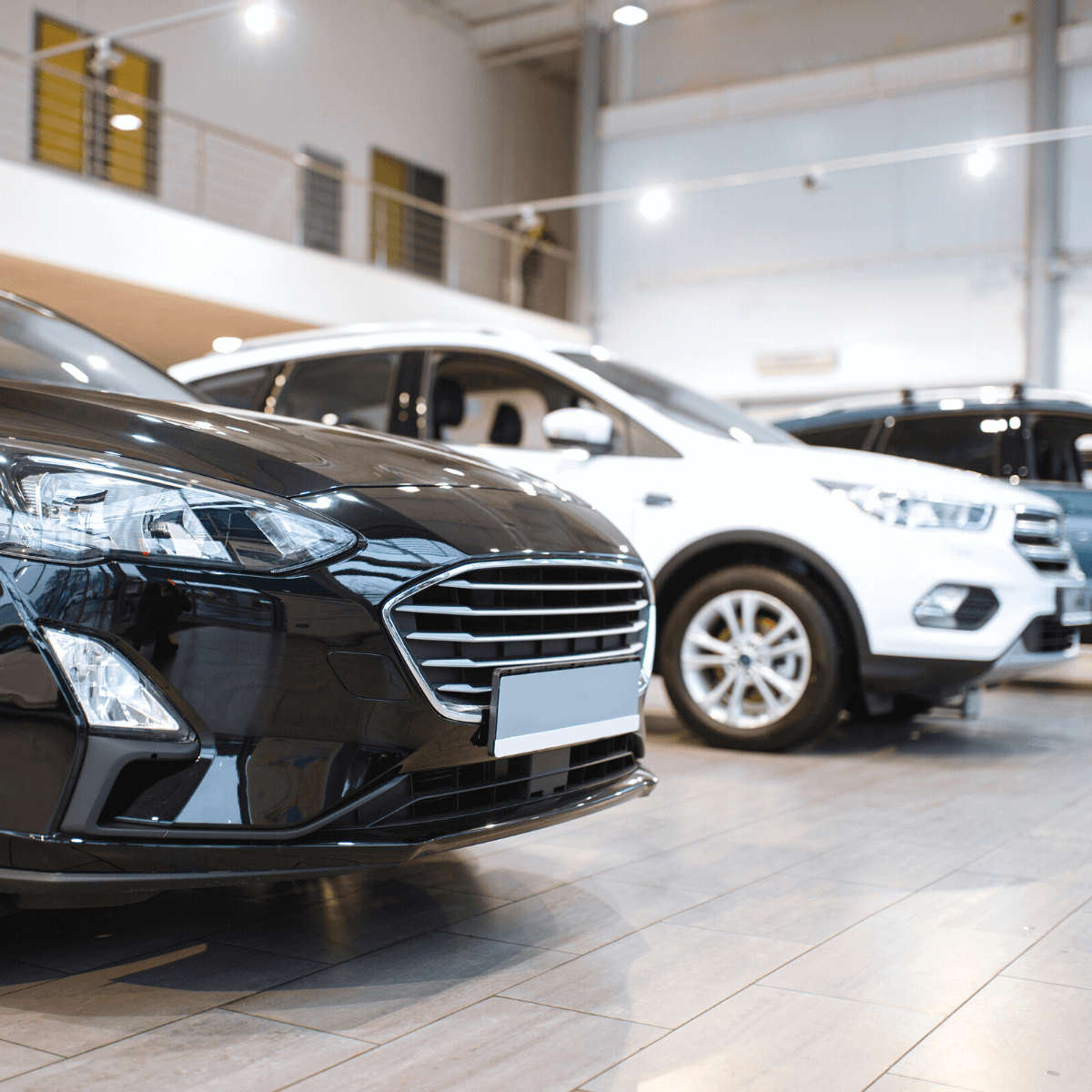

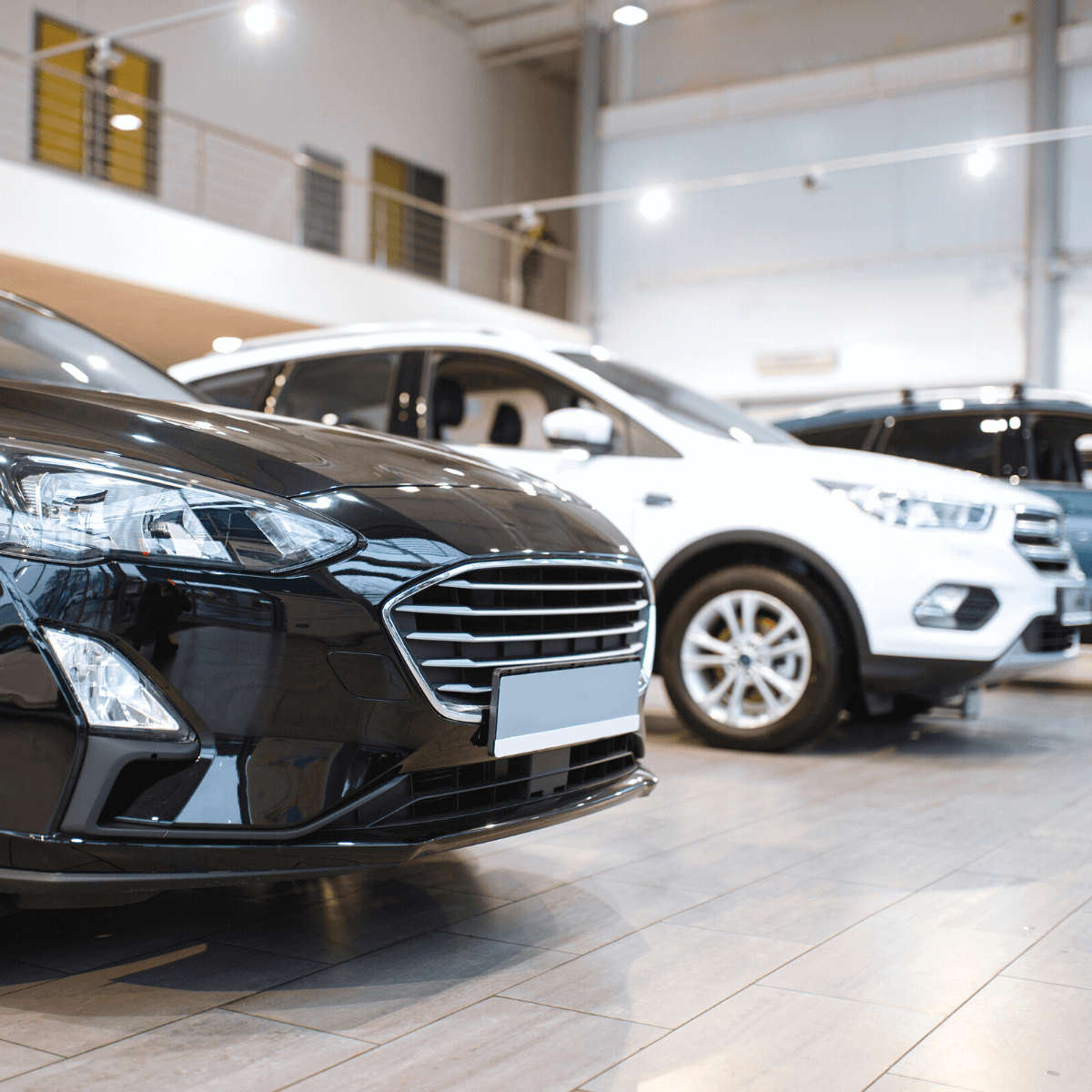

Benefits of In-House Financing Car Dealers Near Me.

. What Does In House Financing Mean At Car Dealerships. However you still have to get approved by the lender by your approval odds may be greater. All loan and interest.

If you purchase a vehicle with a loan from a buy here pay here dealership it means the dealers in-house finance center is lending you the money and youll be making your payments directly to the dealer. Auto Credit Express 2. In-house financing is a type of loan provided by a business directly to a customer allowing them to purchase goods and services offered by the business.

Buy-here pay-here dealerships set their own loan approval requirements. So instead of borrowing 13. Ad Cars Trucks and SUVs.

If a customer purchases a product and doesnt have money to pay the product cost is split monthly based on the plans they. May 26 2021 The Best In-House Financing Car Loans 1. Ad Search Inventory Estimate Payments Find A Local Dealer Schedule a Test Drive Today.

In-house car financing is when a car dealership lends their customers part of the purchase price for their car. In-house financing car dealers are car dealerships that offer financing for your new Toyota vehicle through their car dealership. Various dealerships offering zero to 1500 down payment options for used cars.

Jun 3 2020 These dealers provide in-house financing meaning they sell you the car and loan you the money to purchase the vehicle. In-house financing is when a car dealership offers financing directly to customers instead of working with outside financial institutions like banks or credit unions. These dealerships dont rely on outside lenders to approve consumers for financing.

Financing directly with your car dealership offers Gretna drivers a number of benefits. Compare Models and Find Your Perfect Match. Often called buy here pay here dealerships in-house financing dealerships let you buy and finance a vehicle in one place.

What Does In-House Financing Mean. Check Out the Kia Sedan Vehicle Lineup. When shopping for a vehicle you might come across the phrase in-house financing.

No need to visit a bank to see if you can get a loan. Shop Great Deals and Read Detailed Reviews - Find a Used Car in In Your Area. The dealer takes care of all of the funding paperwork so you dont.

This kind of financing eliminates the need to secure a loan through a financial institution. In-house financing cars means the car dealership does the auto loan legwork for you. You then make loan and interest payments to the dealership.

Because these dealerships finance car purchases they do not need to obtain clearance from a bank or other lender before granting your car loan. In-house financing just means that we handle all the financing for the vehicles we sell. An in-house financing dealership is a buy and pay here dealer sometimes called a tote the note dealership.

In other words you can get your auto loan from the same dealer that sells you your car. You can also use a car comparison site such as Kelley Blue Book to ensure you get the best price for the car youre purchasing. With in-house vehicle financing youre getting a car and a loan all in the same place.

In-house financing car lots operate on their own terms meaning their requirements to get a car loan can be more lax. In-house financing simply means that you borrow money from your car dealership. All loan and interest payments go back to the dealership instead of a bank.

All it means is that the dealerships finance center finances the cars in-house hence the name saving you a trip to the bank to get a loan drawn up. This kind of financing eliminates the need to secure a loan through a financial institution. Youll still need to be approved by the lender but in-house financing cars means you have a better chance of being approved.

If the lenders chooses to finance your loan they may authorize or quote an interest rate to the dealer to finance the loan referred to as the buy rate The interest rate that you negotiate. When you take advantage of in-house financing at dealerships theres no need to pick up a check from your financial institution. So instead of borrowing the money from a bank or credit union you make your monthly payments with interest to the dealership.

Since these dealerships finance car purchases themselves they dont have to get approval from a bank or other lender to grant your car loan. Though many think that in-house financing offered by other dealerships gives you a. This means that instead of making your monthly payments through the bank youll make them at the dealership.

Auto Loan Financing Laws Regulations. It simplifies the work of both the seller and the customer. Your dealership wants you to drive home in the car you really want so theyll work harder to customize a lease agreement that fits your.

What exactly does that mean. We take care of all the paperwork make the loans and collect the payments. What does in house financing mean at car dealerships.

These dealers provide in-house financing meaning they sell you the car and loan you the money to purchase the vehicle. Loan approval standards are. With dealer-arranged financing the dealer collects information from you and forwards that information to one or more prospective auto lenders.

Auto loans are regulated by the federal and state governments to ensure consumers are not being taken advantage of by banks or car dealerships. In-house financing is done when the company or seller has a strong credit-providing facility or deals with a single credit provider to finance their customers. In-house financing dealerships sometimes known as buy-here pay-here dealerships provide financing to car buyers directly.

An in-house financing dealer specializes in securing financing for auto purchasers so youre working with an expert in their field whose energy is not divided between home or other types of loans. Your dealership wants you to drive home in the car you really want so theyll. When financing a car it is important for the.

In-house financing means that you borrow money directly from the dealership to finance your new vehicle. Ad 0 Down Payment Bad Credit OK Get Approved up to 6 Dealerships. While similar to a traditional loan in that youll agree to an interest rate and then make regular monthly or sometimes weekly payments there are some important differences that make in.

In-House Financing Car Dealerships. When you come in to buy a used car from us we take care of everything for you. A car loan will have several terms and conditions that the car buyer agrees to when signing the purchase contract.

Tote the note is another phrase for a buy here pay here. In-house financing dealerships commonly called buy-here pay-here dealerships offer financing directly to car buyers. After all in-house financing car lots will do whatever they can to set you up in a new or pre-owned model.

All loan and interest payments go back to the dealership instead of a bank. Well walk you through the car-buying process from start to finish and. As the name implies its when the dealership extends a loan directly to you rather than relying on banks or other third-party lenders.

You might have heard about in-house financing car dealers but might not know what exactly that means. With a car dealer that offers in-house car financing you make payments to the dealership rather than to a bank.

Few Essential Things You Should Know About Used Cars Car Dealership Dealership Certified Used Cars

Leasing Vs Financing Vs Paying Cash What Makes Sense In Today S Economic Environment Carsalesbase Com

In House Car Financing Is It Right For You Loans Canada

How Do Auto Loans At A Car Dealership Work

News 5 Investigates Beware Of Yo Yo Financing At Car Dealerships

What Is The Future Of Car Dealerships Sitel Group

How To Finance A Car A Guide To Auto Loans And Leases

/car-dealer-showing-new-car-to-young-couple-in-showroom-590778115-fd7e5fcf72564de69103e9f3db58d17f.jpg)

Understanding Rent To Own Cars

Buy Here Pay Here Auto Financing Know Your Options Forbes Advisor

The Advantages Of In House Financing At Car Dealerships Auto City Credit

Leasing Vs Financing Vs Paying Cash What Makes Sense In Today S Economic Environment Carsalesbase Com

Tips To Get The Best Vehicle Finance Deal At Your Dealership

Car Dealers Optimistic Supply Of New Vehicles Will Come This Spring Cbc News

What Is In House Financing Lendingtree

What Are In House Financing Dealerships Credit Karma

How Does Floor Plan Financing Work Nextgear Capital

Speaking Car Dealership Lingo A Guide For Terms Used At A Dealership